Dan Kamau, the Diaspora University Town (DUT) project director, has kicked off the DUT 20,000 jobs and Ksh 200 billion wealth-creation plan for 2026 – 2030. During a Saturday Zoom meeting, he said that DUT had 50 jobs at the close of 2025 and had created Ksh 10 billion in wealth. He said the 2026goal is to have more Kenyans join DUT and work as the project kicks off its 2026 job creation and property development plans. He thanked Diaspora Kenyans, Ndara B Community, and Kenyans who were part of DUT by December 2025.

2026 Job Creation Plan

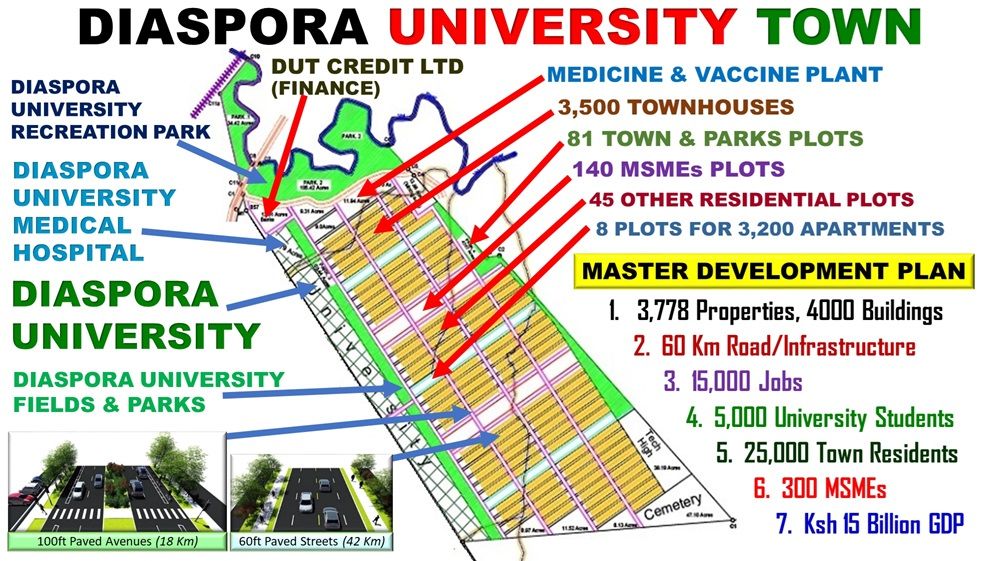

The 2026 job creation plan is for 4,000 jobs at DUT and 3,000 jobs at Ndara B as follows: Diaspora University Town (300 jobs), Diaspora University & Hospital (200 Jobs), 100 DUT MSMEs (3,500 jobs), and Ndara B 30 MSMEs (3,000 jobs).

2026 Property Development Plan

The 2026 property development plan is to produce 150,000 square meters of building space (University: 12,000 Sqm, Town: 850 Sqm, MSMEs: 17,800 Sqm, & Townhouses: 120,000 Sqm). The DUT Design Build plan for the 150,000 Sqm is set at 48 weeks.

2026 – 2030 Development Plan

The 2026–2030 development plan is for achieving the following by 2030: Town with 25,000 Residents, 5,000 student’s university and 15,000 jobs; Diaspora University, first 4 year class graduation; a Level 5/6 University Hospital fully operational; 1.2 million Sqm of space made up of about 6,900 properties; 330 MSMEs/Organizations operational, and Ksh 200 billion new wealth through properties and MSMEs.

Ksh 70 billion Residential Property Wealth

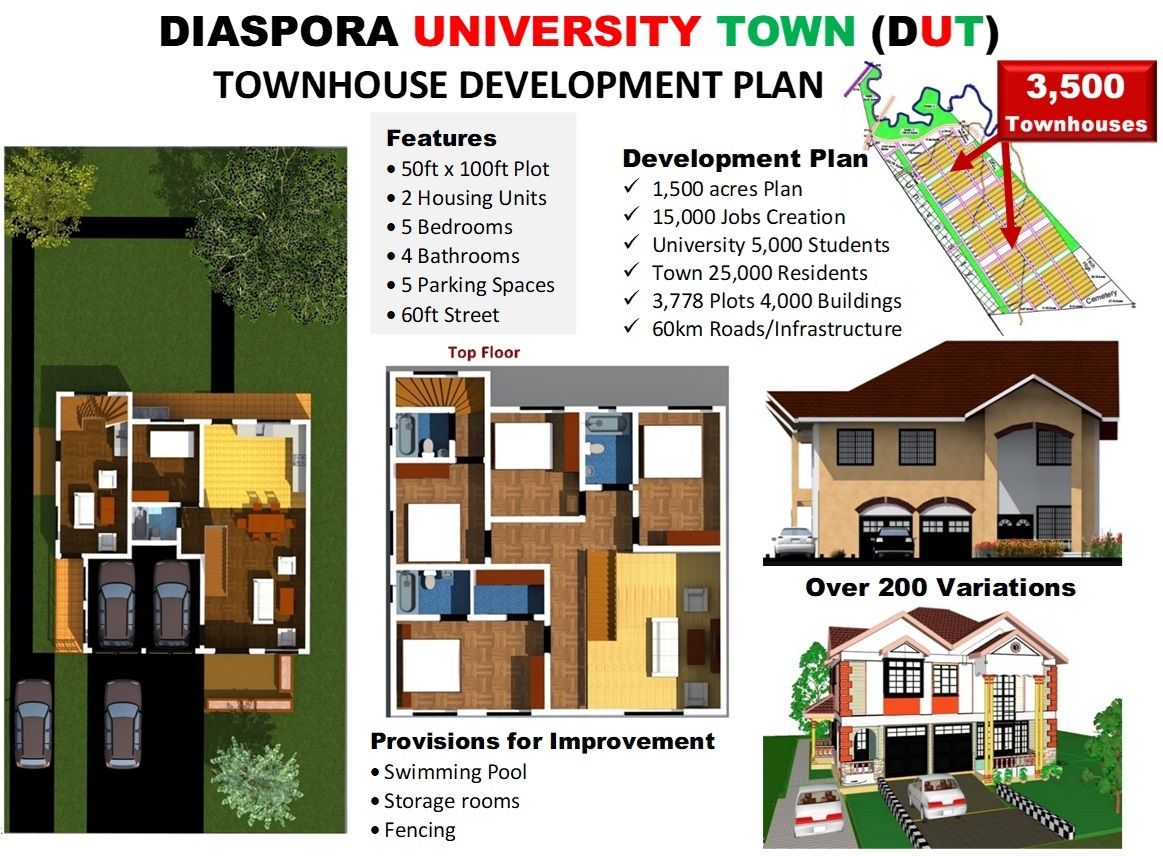

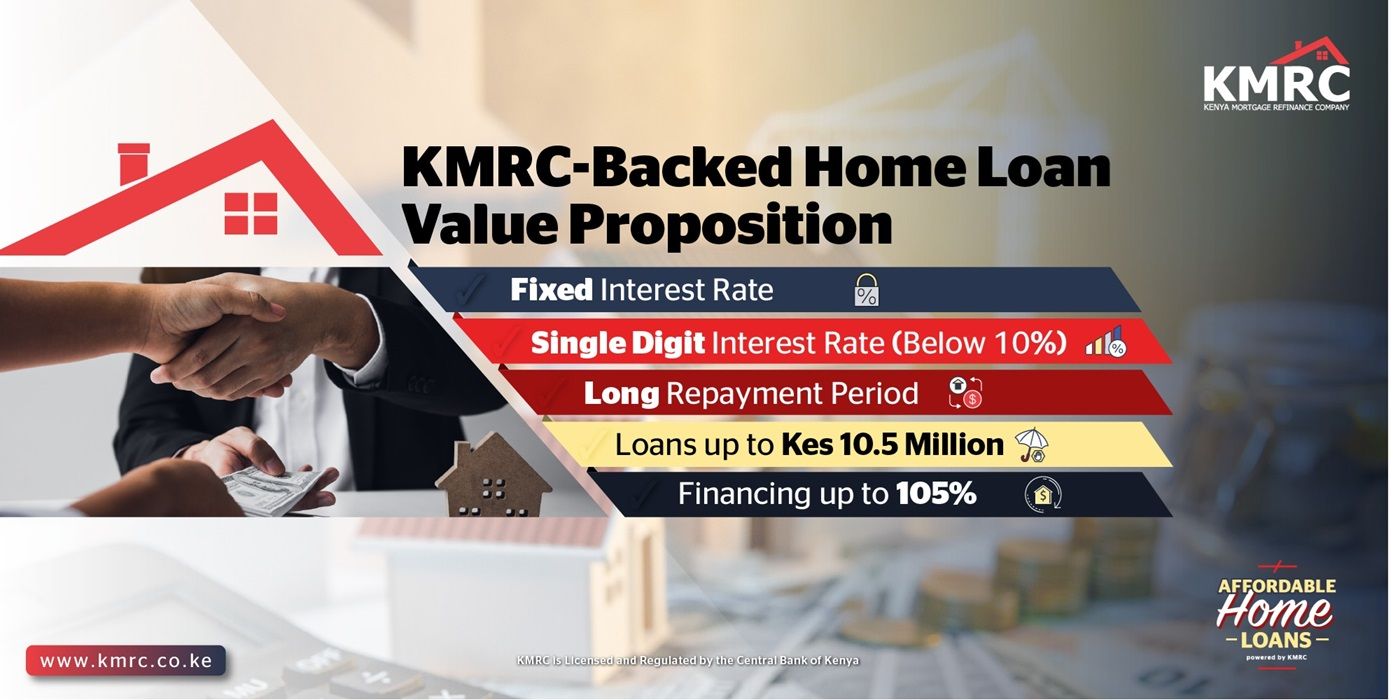

Dan presented the DUT 6,745 residential properties plan as one that will house the 25,000 residents and some of the 5,000 university students. The completed properties are expected to be valued at about Ksh 70 billion in 2030. The houses will be mainly financed through the KMRC product, which, by the close of 2025, had been advanced through 27 banks and SACCOs in Kenya.

The current investment opportunity is to become a townhouse developer through a THIDA of the remaining 2,180 units from the 3,500 plan. The goal is to have 1,200 units taken through THIDA's development plans of 1 to 4 units. The remaining 980 units will be taken by 980 persons who take up the first DUT jobs.

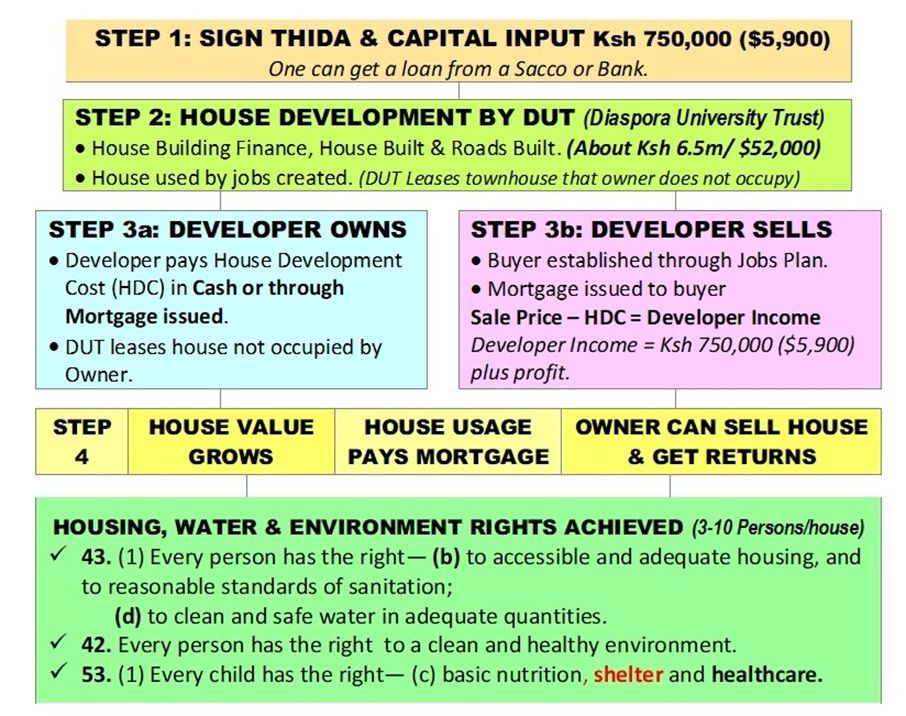

Regarding the THIDA Capital finance of Ksh 750,000, Dan advised interested persons to apply for the bank's unsecured personal loan products. He gave the examples of the KCB Personal Unsecured Non-check-off Loan of up to Kes 4 Million with no security and a repayment period of up to 48 months (4 years), and the KCB Bank Personal Unsecured Check Off that is offered as follows: “Get a check off loan as a government employee, or a company that has an agreement with KCB Bank. The check-off loan of Kes 20,000 up to Kes 10 million is repayable in up to 120 months (10 years).”

In an illustration based on someone taking a Ksh 750,000 loan for 120 months with a monthly payment of about Ksh 15,000, Dan said that a person can pay, say 20 instalments of Ksh 15,000, totaling Ksh 300,000, in 20 months. On the other side, the house construction would be ongoing, and once complete on the 20th month, the following would apply:

- The loan balance of about 700,000 plus the house development cost of Ksh 6.5 million would be issued a mortgage of Ksh 7.2 million at 9% interest for 25 years. The mortgage monthly payment would be about Ksh 61,000.

- DUT would lease the completed house at the budgeted lease rate of Ksh 65,000.

- The lease amount of Ksh 65,000 would pay the monthly mortgage of Ksh 61,000.

Dan projects that, by 2030, as the town's GDP reaches Ksh 20 billion, the market value of the townhouse will surpass the Ksh 10 million and could reach Ksh 15 million. Using this value, he said, if the principal mortgage loan balance of the Ksh 7.2 million mortgage is at Ksh 7 million mortgage, the homeowner would have a wealth of Ksh 3 - 8 million in the Ksh 200 billion wealth created.

He further said that these townhouses will always have buyers as the university, the hospital, and diverse MSMEs continue to operate in the town.

Ksh 100 billion MSMEs Wealth

The MSMEs' wealth of Ksh 100 billion will be derived from the valuation of the 330 MSMEs and Organisations that will result from the DUT and Ndara plans, Dan informed those attending the meeting.

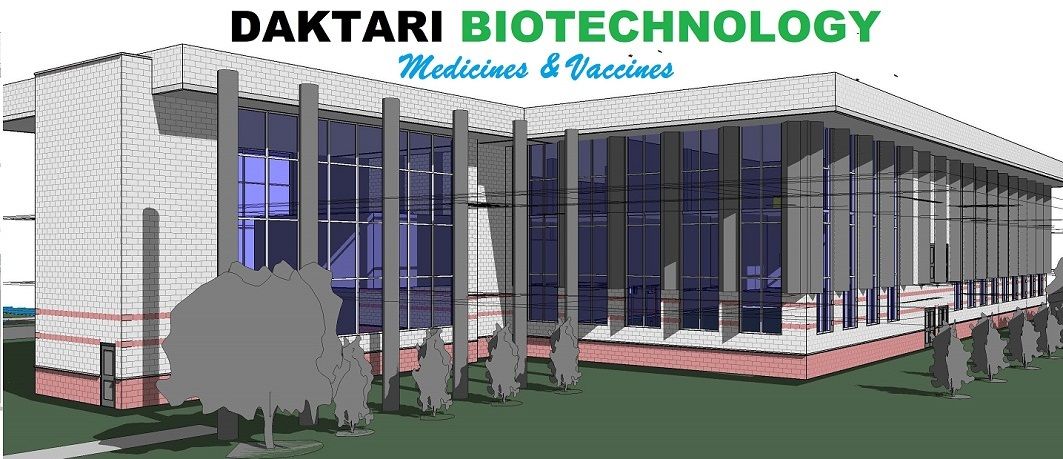

He said Daktari Biotechnology Ltd is expected to achieve a valuation of Ksh 20 billion. He added that today, Kenyans are being invited to invest through an angel investment of Ksh 25,000. The investment would be valued at Ksh 100,000 within the Ksh 20 billion valuation. By 2030, this works out to about a 32% return per annum.

When explaining the Medicine and Vaccine company's growth, Dan pointed to the current discussion of Safaricom Shares being sold at $1.6 billion (about Ksh 200 billion). He said the value of the share capital has grown to over Ksh 1.3 trillion and that Daktari Biotechnology Ltd, Ksh 20 billion, is achievable by 2030.

He said the other Ksh 80 billion will be the valuation of about 50 MSMEs held through shares and another 250 MSMEs as individual MSMEs. He thanked all those who have started working on MSMEs and singled out Anne Kirie, who has kicked off DUT Clothing MSME, and Peter Mrare, who has kicked off car services, repairs, and disposal management MSME.

He invited those interested to start an MSME to visit the DUT site or email him at dan@dut.or.ke to begin their journey toward achieving new wealth.

Ksh 30 billion Diaspora University

The Diaspora University's assets, including its educational properties, hospital, park, and others, are expected to exceed the Ksh 30 billion valuation by 2030. This will be reflected as endowment Ksh 20 billion and Ksh 10 billion as loans from banks. Dan said one of the assets in the Ksh 30 billion will be the university hospital building with medical equipment, in accordance with a level 5/6 hospital.

DUT Finance Plan

Talking about the project's financial plan, Dan said the following plans will be applied:

The first finance plan, already applied, is reflected in the DUT assets (Trust, Townhouse Developers, and MSMEs) valued at about Ksh 10 billion by the end of 2025.

The second finance plan that will be applied in 2026 consists of the THIDA and MSME plans, cash and intellectual asset inputs. Dan's said the goal is to have the DUT assets grow by over Ksh 5 billion in the next four months, through these plans.

The third finance plan is the 20,000 jobs, 100 million human resource hours plan. The 100 million hours will generate over Ksh 50 billion in financing, which will be reflected in the banking sector's assets.

The fourth finance plan is the Ndara B Community natural resource plan. The Ndara B Community will implement this plan. 28 MSMEs will grow banking sector assets.

The fifth finance plan, valued at about Ksh 40 billion, will be funded by KMRC finance, as over 6,000 persons and 6,700 residential houses are beingfinanced.

The sixth finance is about Ksh 30 billion to finance University and MSME property, equipment, vehicles, and other assets.

Referencing the top 100 banks in the world, Dan says that the DUT plan will grow Kenya's banking assets by over Ksh 70 billion by 2030.

To investors in DUT Credit Ltd, he says the 2030 DUT goal is for the company's assets to surpass Ksh 10 billion.