Dan Kamau, the Project Director of Diaspora University Town (DUT), held talks on the DUT plan for university and town development at the KCB Bank MSMEs event in Voi. The event was attended by teams from KCB Bank's Nairobi, Mombasa, and Taita Taveta branches in Voi, Wundanyi, and Taveta. KCB Bank Kenya's Managing Director (MD), Annastacia Kimtai, led the team on a visit to Voi. Also present was Governor Andrew Mwadime of Taita Taveta County. The Governor worked at the Bank before joining politics.

Dan and Ronald Mwagombe of Ndara B Community were invited to the event by Benson Mutie, the KCB Bank Voi Branch manager. They were happy to meet Simon Hollanda from KCB Bank Nairobi and Joshua Kiptoo from KCB Bank Mombasa, who had visited the DUT site earlier during the year.

On the sidelines of the event, the bankers provided updates on the bank's progress on the proposed financial partnership plan they are establishing as they look to partner with over 500 Diaspora Kenyans and 3,000 Ndara B Community members who are founders of the DUT project. Simon said a document is already prepared, and the Voi Branch manager will be presenting it soon.

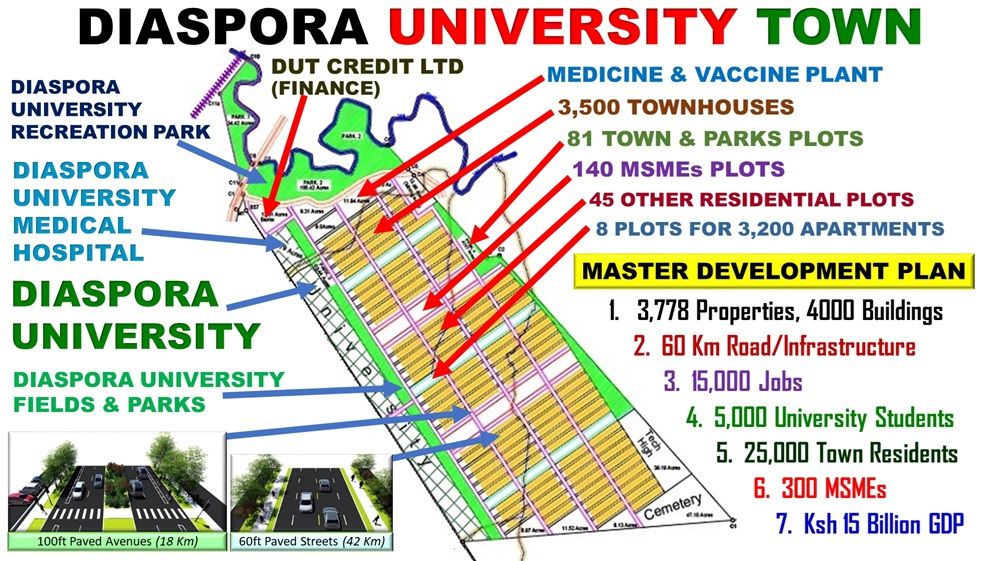

DUT Master Development Plan is a plan for developing 3,778 properties, along with 60 kilometers of roads and infrastructure to service the properties. The plan is also developing a University for 5,000 students and a town with 15,000 jobs, 25,000 residents, and 300 micro, small, and medium-sized enterprises (MSMEs).

Dan, alongside WPI professors, created the plan when living in Worcester, MA. Today, the plan is being developed by Diaspora University Trust. As of 2024, the DUT plan has assets valued at Ksh 6 billion. The goal is to continue growing the assets to reach Ksh 200 billion by 2030. The assets established would include the 3,778 properties, Diaspora University assets, and 300 assets of MSMEs and organizations.

KCB's partnership role would be to issue loans of about Ksh 50 billion through diverse financial products. The loans would be issued as mortgage loans for the 6,745 residential properties, as well as Diaspora University, MSMEs, and the Organization’s property and asset loans.

The 6,745 residential properties include: 3,500 townhouses, eight properties planned to have ten buildings with 3,200 apartments, and 45 additional residential properties. This residential houses development plan is aligned with the KCB Jenga Dreams Mortgage finance product, which offers 105% finance, up to Ksh 10.5 million, at 9.5% interest, and a term of 25 years. About 500 Diaspora Kenyans and Kenyans are today advancing this plan. The financial opportunity for the Bank is to issue mortgages of approximately Ksh 35 billion.

Once the 6,745 properties are completed by around 2030, Dan estimates that the collective valuation of these properties will exceed Ksh 70 billion. He estimates that the banks' financing will be approximately Ksh 60 billion, as Diaspora Kenyans who are initial property owners sell the properties to those taking up jobs in the town.

The remaining 225 properties will be developed by Diaspora University, MSMEs, and Organizations for educational, town management, business, religious, and other purposes. These properties are where the 15,000 jobs will be established.

Prof. Phillip Mutisya of Raleigh, NC, is the lead founder of the Diaspora University academic system. He is in Kenya and is working with other Diaspora and Kenyan scholars to open the university.

Dan says that by 2030, the Diaspora University will have created 2,500 jobs at the university and the hospital. He says that Diaspora University, by then, will have assets valued at Ksh 30 billion. The assets will be held as properties, investments in MSMEs, and a student finance fund. He says the bank will have an opportunity to finance about Ksh 10 billion of these assets.

300 MSMEs will be established, creating approximately 12,000 jobs. Daktari Biotechnology Medicine and Vaccine, founded by Dr. Wilson Endege, scientists, and angel investors, is developing a medicine and vaccine plant at DUT. The company aims to create about 500 jobs and achieve a valuation of approximately Ksh 30 billion.

The DUT Design-Build (DB) plan, executed by design-build professionals, will be through an MSME established by DB professionals and the Trust. The plan will create approximately 2,000 jobs as a 60 km road and infrastructure network, along with buildings, are constructed on 3,600 plots. As the company completes the Ksh 39.5 billion DUT design-build budget and commences construction in other locations, it is estimated to have a valuation of over Ksh 25 billion.

The 300 MSMEs and organizations that establish in the town will collectively achieve a new wealth of about Ksh 100 billion through their 140 MSMEs properties and business plans. Banks with financial loans will support these MSMEs. The current estimate is that KCB Bank will lend approximately Ksh 5 billion to micro, small, and medium-sized enterprises (MSMEs).

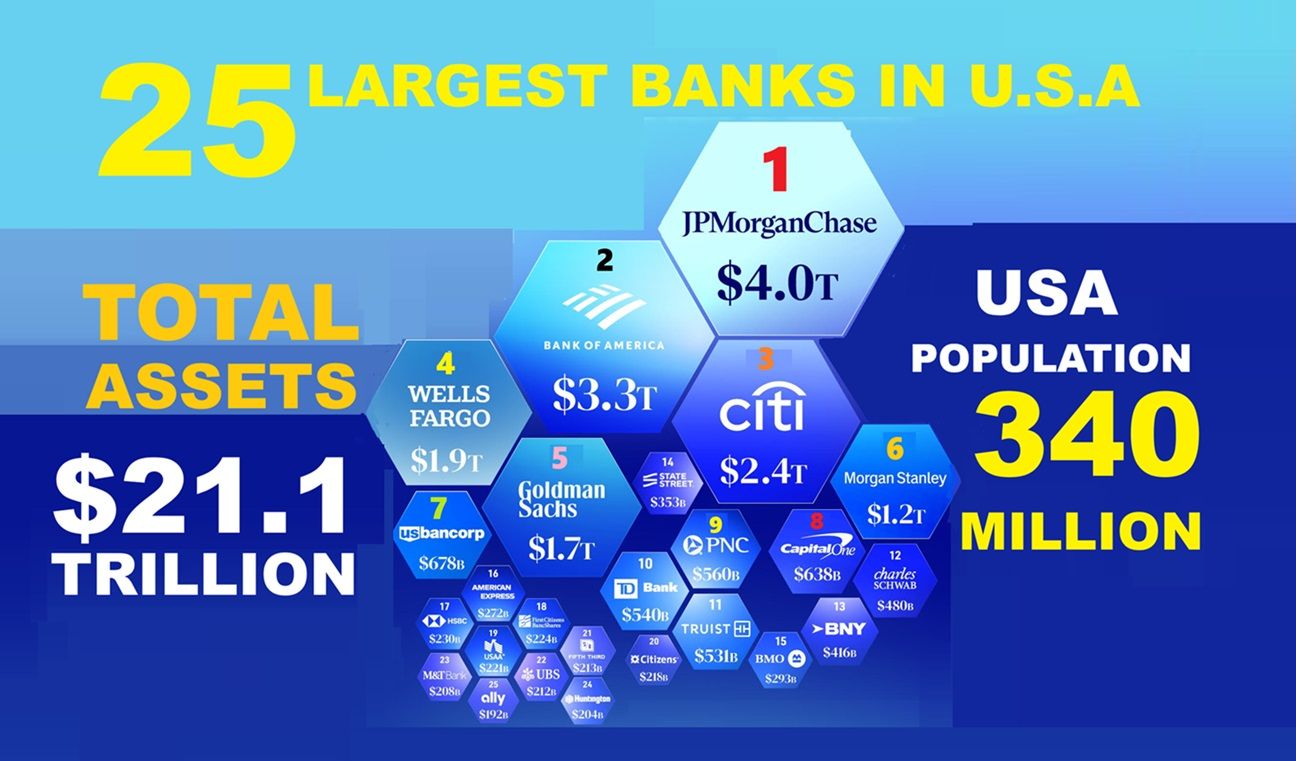

Dan was excited to hear the KCB Bank Managing Director say that the bank's goal is to offer solutions and is ready to innovate to achieve solutions that lead to job creation. He was also excited to hear the MD say the bank's assets have grown to over Ksh 1.3 trillion.

Once the bank issues approximately Ksh 50 billion in loans, the DUT plan will have contributed to increasing the bank's assets. Comparing the bank assets of the 25 largest banks in the U.S to Kenya Banks, Dan says job creation abroad and the remittances are as a result of bank asset growth. The faster banks in Kenya grow bank assets through lending, the faster jobs will be created.

The creation of the Ksh 200 billion new wealth will also result from Diaspora remittances investment plans and the 100 million hours of human resource application as the plan develops and sustains a university, a town, 300 MSMEs and Organizations and achieves a town with a 5,000 students university, 15,000 jobs, 25,000 residents, and 1 million visitors a year.