Dear Diaspora Kenyans and fellow Kenyans, my name is Dr. Wilson Endege. I am a Kenyan-born Diaspora biotech professional residing in the U.S., with thirty years of experience in the pharmaceutical sector. My career includes academic positions at Harvard University and significant roles within the pharmaceutical industry at Chiron Diagnostics Inc., Millennium Pharmaceuticals Inc., now Takeda, and AstraZeneca Pharmaceuticals. I also hold five patents related to cancer biomarkers.

Since moving to the United States, I have focused on determining how best to contribute to advancing medicine and vaccine research and production in Kenya. I am pleased to be part of Diaspora University Town (DUT), which is making significant progress in developing a university, hospital, town, medicine vaccine company, and various other enterprises.

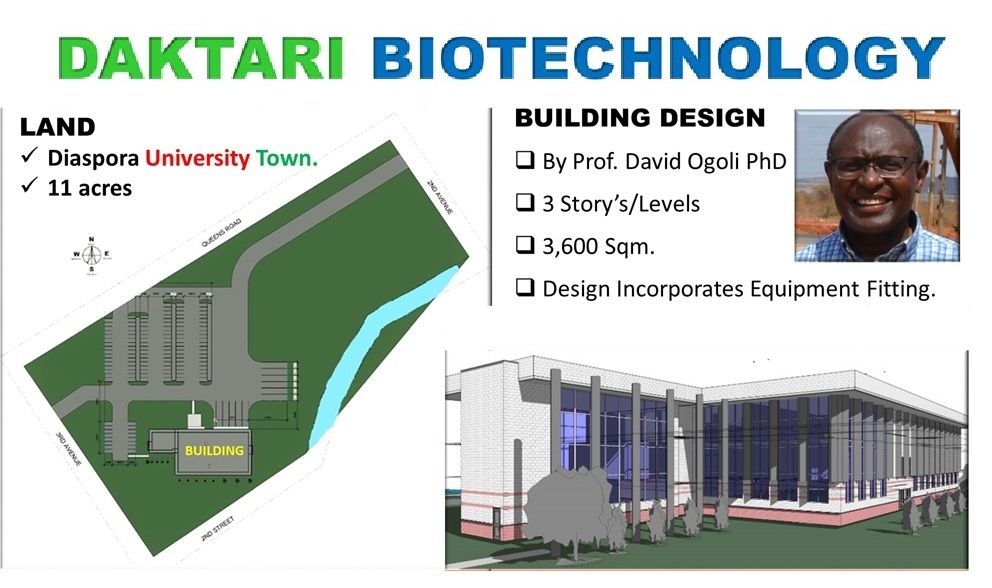

In 2016, during my visit to Kenya, I started Daktari Biotechnology Ltd. Since then, five scientists possessing technologies and other intellectual resources for medicine and vaccine development and manufacturing have become investors in Daktari Biotechnology Ltd. Among them are three Kenyan diaspora scientists: Dr. Patrick Shompole from Pullman, WA; Dr. Benson Edagwa from Omaha, NE; and Dr. Bernard Ayanga from Houston, TX.

Today, I invite Diaspora Kenyans, Kenyans, and those interested in becoming Founding Angel Investors of Daktari Biotechnology Ltd to join us. This initiative mirrors similar practices commonly seen in the United States. In 2024, fifty of the largest pharmaceutical companies were reported to have market capitalizations ranging from $15 billion to $580 billion, with a combined valuation of $4.7 trillion. Much of this capital is attributed to the share capital of the founding scientists and angel investors. These companies' revenue is approximately $500 billion. They are paying dividends of about $100 billion.

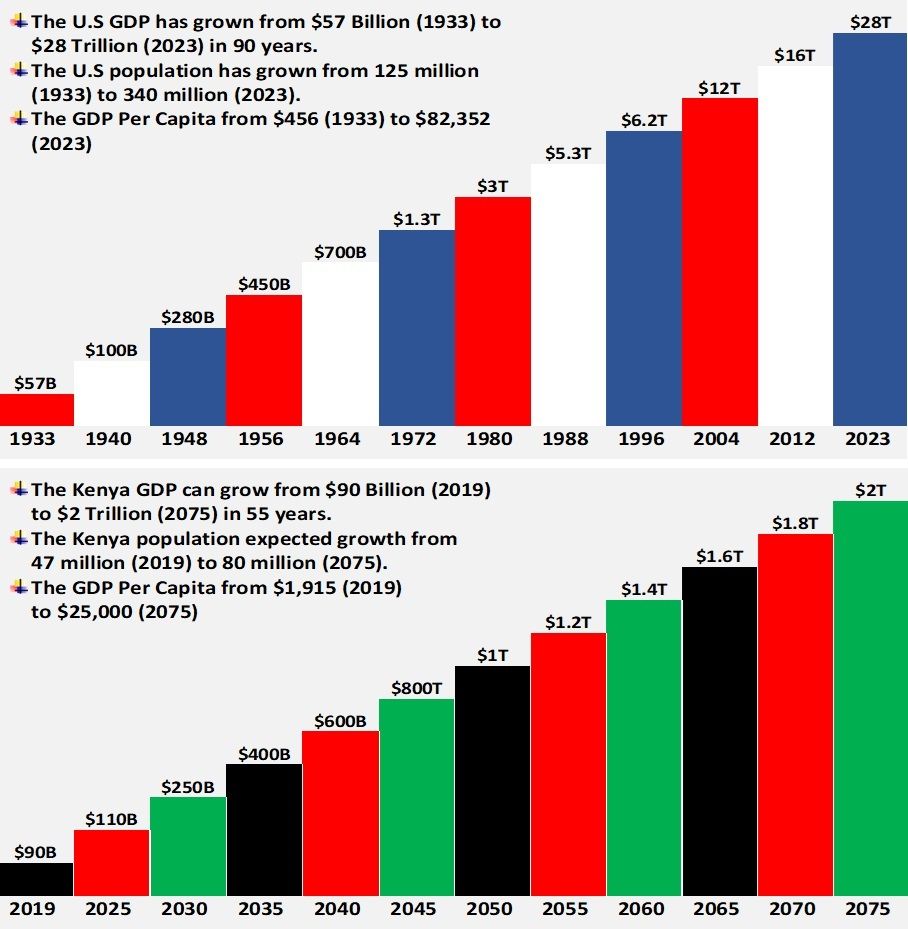

Daktari Biotechnology aligns with similar developments we have overseen in the United States over the past 30 years. During this time, the U.S. GDP grew from $6.2 trillion in 1996 to $29 trillion in 2025. The pharmaceutical sector contributed to this growth and currently represents around 2% of the GDP.

Daktari Biotechnology possesses advanced technologies, four plots at Diaspora University Town, complete designs for our initial plant, and various pre-formulated medicine products. We seek an additional $12 million in capital to construct the medicine and vaccine facility, initiate clinical trials, and open pharmacy outlets. This capital requirement will be invested through 60,000 investments of $200/Ksh 25,000 each.

The $12 million angel investor’s capital will constitute 30% of the company's shares. This capital is projected to grow to $90 million as the company's market value increases to $300 million. Consequently, each $200 investment is anticipated to appreciate to $1,500, as it contributes significantly to improving Kenyan healthcare. Furthermore, dividends are expected to be distributed starting in the fifth year.

My research experience at Harvard University and within the pharmaceutical sector led to five patents on cancer biomarkers. I firmly believe that advancing cancer research through Diaspora University and Daktari Biotechnology Company will yield significant progress in developing treatments for cancer, autoimmune, and other diseases.