During the Diaspora University Town (DUT) 2025 workshop, the DUT 20,000-job plan and the KCB Bank finance plan were presented. The KCB Bank team was present and explained how the bank would offer diverse banking products. On his part, the DUT Project Director, Dan Kamau, said that the project is integrated into the KCB Bank finance plan for bank account openings and loans.

KCB Bank offers four categories of account opening and loans: For You, For Your Biashara, For Corporates, and Diaspora. The workshop participants were happy with the 2030 goals of achieving the first four-year class graduation, creating 20,000 jobs, offering Ksh 70 billion in loans, and establishing a new wealth of over Ksh 150 billion.

FOR YOU & DIASPORA

Kenyans and Diaspora Kenyans have opened and continue to open KCB Bank accounts. Ndara B Community and those taking up jobs are opening accounts. Dan's target is 2,000 Diaspora Kenyans, and over 20,000 Kenyans working and investing in the project have KCB Bank accounts.

The KCB Bankers presented the KCB finance plan, “For you and Diaspora.” They showed the loan products that Diaspora Kenyans and Kenyans will be issued: Secured loans, Unsecured loans, Mobile Loans, Home loans, Mortgages, Vehicles, and Asset Loans.

Dan is working to have the DUT Plan have over Ksh 35 billion in individual loans by 2030, mainly from the 3,500 townhouses and 3,200 apartments built.

FOR YOUR BIASHARA

Led by Daktari Biotechnology Ltd., which is setting up at DUT, Micro Small and Medium Enterprises (MSMEs) continue to open KCB Bank accounts. Dan said that as 300 MSMEs and organizations are established in DUT and another 30 MSMEs in the Ndara B Community land, these MSMEs and organizations will open close to 300 KCB Bank accounts.

The KCB Bankers showed and spoke on the loan products for MSMEs and Organizations on the KCB Bank website: Small Business, SME, Agri-Business, Chama Loan, and Merchant Cash Flow Loan. The financing is further categorized as LPO Financing, Invoice Discounting, Asset-Based Finance, and Clean Energy Financing.

The DUT plan estimates that by 2030, about 300 MSMEs will have started and become operational at DUT, and Ndara B. These 300 will be supported by about KSh 25 billion loans from KCB Bank for their business, assets, and property needs.

FOR CORPORATES

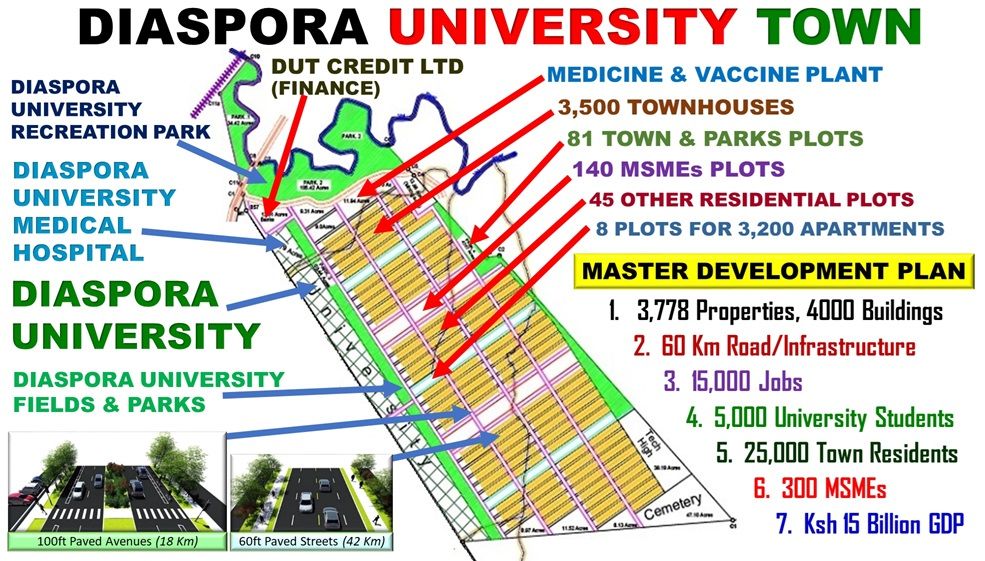

Diaspora University Trust, a corporation with assets valued at Ksh 4.8 billion, is classified as a corporation. The Trust has already opened KCB Bank accounts. The Trust is also developing several plans: a University Plan, a Town Plan, the Design-Build Plan, 3,500 Townhouses, 3,200 apartments, and the 330 MSMEs plan.

The KCB Bank bankers presented the loan products for Corporates listed on the website: Asset-Based Finance, Trade Finance, Project Financing, and Mortgage.

The Trust is currently looking to establish project finance and, thereafter, property and asset loans. By 2030, some of the Trust assets will be financed by KCB Bank. About Ksh 10 billion will be borrowed to finance 15 university and town properties, equipment, vehicles, and other Assets.